De-dollarization is a global trend in which currencies other than the US dollar are used in trading commodities such as oil and gas, purchasing US dollars for foreign exchange reserves by countries, bilateral trade agreements, and dollar-denominated assets.

Recently, the Spokesperson of the President’s Office, Mohamed Mabrook Azeez and Finance Minister Ibrahim Ameer have both stressed on a solution towards an independent fiscal policy.

Spokesperson Mabrook informed that the government’s thinking is to introduce a structural reform to reduce the amount of shocks the economy of Maldives receives, and further research is being conducted into de-dollarization. This report looks at what de-dollarization is and the stance of global superpowers towards the trend.

United States

Since the inception of the Bretton Woods System, the US dollar has been the medium of exchange in international trade. However, in recent years, de-dollarization has been on the rise. The de-dollarization process is being carried out in the following ways.

- Treasury Bills

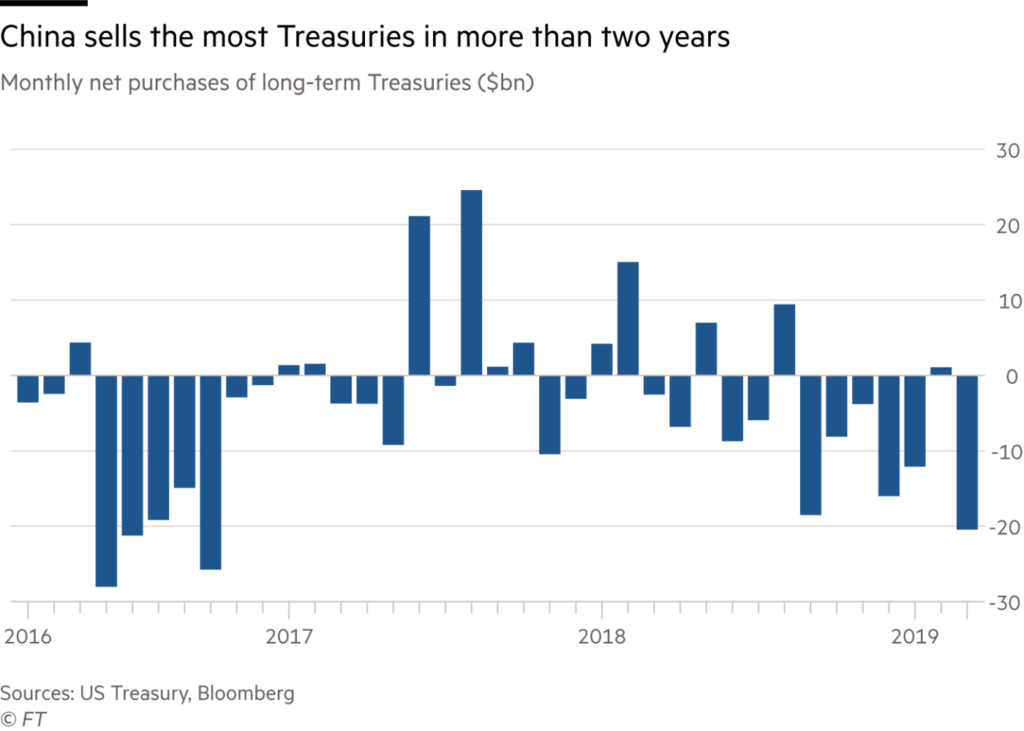

From 2018 to 2020, global central banks have decreased their US debt holdings. In March 2020, the US Federal Reserve purchased over US$ 1 trillion Treasuries following their pledge of unlimited quantitative easing. As the Federal Reserve became the largest receiver of US Treasuries, it indicates that global economies are losing confidence in the US treasuries in its zero default risk. For instance, one month and three month Treasury bills generated a negative yield while the 10-year bills were below 1% for the first time in history.

- Forex Reserves

The decrease in reliance on US dollars is not limited to the treasury bills. Among all IMF member countries, the share of US dollar in the foreign exchange reserves has dropped from 72% in the year 2000 to 61.99% in March 2020. While the share of US dollar in forex reserves still ranks at number one, the drop indicates a weakening dollar and a poor economic outlook for the US economy. Central banks all over the world are diversifying their gold reserves. In order to negate the risks brought by US dollars, US’ share in global gold reserves dropped from 23.64% in 2019 to 15.5% in 2020.

- SWIFT System

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) system is a messaging network system that financial institutions all over the world use to securely transmit information through a standardized system of codes. The US-dominated SWIFT system is the most widely used system among financial institutions. When using the payment system, all information and transactions transmitted go through US financial institutions and are ultimately subject to US laws even though the transactions are in no way related to the US. Consequently, the reliance on US dollars as a medium in international trade has reduced among G20 members.

In May of 2020, the market share of US dollars in the payment market which stood at 40.88% decreased by 3.22% compared to March 2020’s 44.1%.

While the figures for 2020 indicate a weakening confidence in the power of the US dollar, it should be noted that 2020 was a turbulent year for the US amidst racially fueled protests, the Covid19 pandemic and the presidential elections. The country had slow economic growth and as the hardest hit country in terms of the Covid19 Pandemic, the economy fell into a recession during the year.

With the election of Joe Biden as the new president and multiple vaccines produced against the Covid19 virus, the economy is likely to bounce back, the money market instruments have a stronger backing, and the strength of the dollar is likely to improve. Furthermore, the stand alone figures showcase a downward trend, however should not be relied upon without a comparison to other currencies such as the Sterling Pound, Euro, Chinese Yuan and the Japanese Yen.

China

- Bilateral trade agreements using Yuan

China has been on the forefront in terms of de-dollarisation since 2011. The country has signed several bilateral trade agreements where the countries use their national currencies. Some countries include Iran, Russia, Brazil and Qatar.

- CIPS

In 2015, the country introduced a clearing and settlement services system to internationalise the use of Chinese Yuan named Cross-Border Interbank Payment System (CIPS), that was backed by the People’s Bank of China. The system allows financial institutions to settle yuan onshore rather than using offshore clearing banks..

In 2019, CIPS disclosed that it processed over 130 billion yuan or US$ 19.4 billion in a day.

According to Nikkei, the system is used by close to a thousand financial institutions in over 96 countries as of June 2020. From 30 banks in Japan, 23 banks in Russia and over 30 African banks receive yuan based funding through CIPS under Beijing’s Belt and Road Initiative.

However, as of now, CIPS still remains reliant on SWIFT for cross-border financial transactions and messaging but it is important to note that the system has the potential to be independently operated and maintain communication directly between financial institutions.

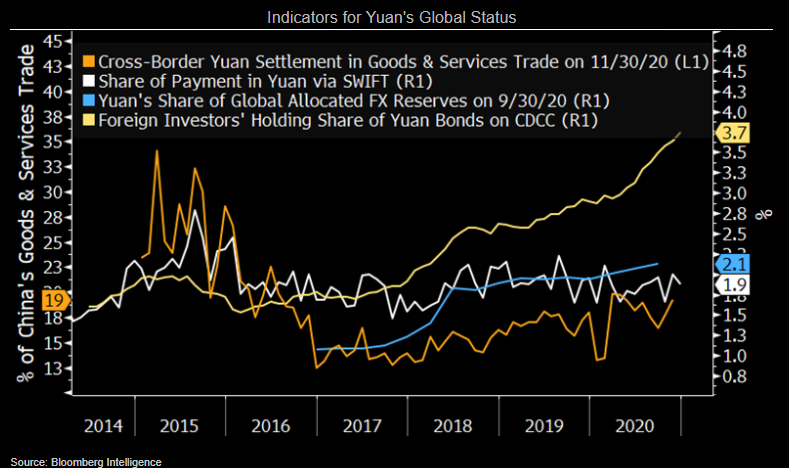

Even though China is making huge steps to de-dollarize and globalize Yuan, the process has been slow. Below 20% of China’s cross-border trade settlement uses Yuan as a currency, indicating its regression as a settlement currency. As of December 2020, the Chinese Yuan only contributed below 2% as a payment currency in terms of International payments via SWIFT. Even as a reserve currency, yuan falls behind the US dollar. In the Quarter 3 of 2020, Yuan’s share grew to a record 2.1% as a reserve currency, however, is still extremely low compared to the US dollar’s 60.5% share. In the year 2020, overseas investors held almost 30% of US bonds compared to the 3% yuan bonds.

Russia

- Bilateral trade agreements

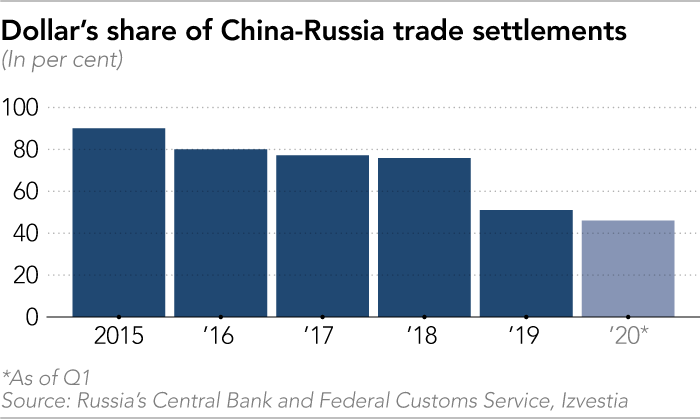

Russia is another major contender in de-dollarization. The country has significantly reduced their usage of the US dollars in bilateral trade agreements with China. In 2015, approximately 90% of transactions between the two countries were carried out in US dollars. However, the figure decreased to 51% in 2019. In the first quarter of 2020, the US dollar made up only 46% of settlements between Russia and China.

- Currency Swaps

In 2014, Russia and China proceeded to sign a 3 year currency swap deal valued at Chinese Yuan 150 billion (US$24.5 billion) and this deal was extended for another three years in 2017. The currency swap deal allowed both economies access to each other’s national currencies without relying on the foreign exchange market.

- US debt holdings

Furthermore, Russia’s foreign exchange reserves cut down its dollar holdings by over half, amounting to US$101 billion.

European Union

The European Union is faced with a need to de-dollarize and promote the usage of Euro. Concerns such as the EU countries paying 80% of its energy needs in dollars even though the US supplies only 2% of raw materials in Europe are being voiced out.

- INSTEX

As aforementioned, the usage of SWIFT subjects other countries to US laws in doing financial transactions. In 2018, the US’ unilateral withdrawal from the Iran Nuclear deal led to sanctions on Tehran. The situation adversely affected European Multinational companies as they could face legal consequences if trade with Iran continued. Thus, the European Union formed the Instrument in Support of Trade Exchanges (INSTEX), a European special-purpose vehicle that enabled non-USD and non-SWIFT transactions to take place. The union has used the system only in emergencies where the EU exported medical equipment to combat the Covid19 Outbreak in Iran without breaking US sanctions.

However, the European Union plans on using INSTEX to continue trading with Iran.

The Maldives

Rising tensions in international trade over tariffs, sanctions and protectionism between countries are forcing many countries to stabilize their own currencies and GDP by de-dollarization and Maldives is one such economy. The country is heavily dependent on US dollars as the majority of the country’s main industry i.e. the tourism industry’s operations and transactions are US dollar based. With the rise of Covid19 during the past year, the island nation was forced to close its borders and thus, halted the US dollar inflow into the economy. Even though the Maldives Monetary Authority injected large amounts of US dollars into the economy, domestic trade still suffered. This uncertain flow of US dollars heavily distorted the market, national debt and pushed the country further into a recession.

In 2020, the price of the US dollar in the black market rose above MVR 20, a heavy increase compared to the official currency exchange rate of MVR 15.42.

With such distortions to the market due to the heavy reliance on the US dollar that hindered the macroeconomic process, the country is looking to dedollarise in the coming years. The government is focused on using the Indian Rupee and the Chinese Yuan in trade agreements with its major trade partners which are India and the People’s Republic of China, respectively.

Is the US dollar still king?

According to an economist at Harvard University, the de-dollarization movement is not an easy feat as the US dollar has 3 major advantages against other currencies: its ability to maintain value due to limited inflation and depreciation, the tremendous size of the US economy, and its liquid and open financial markets.

The US dollar runs the risk of de-dollarization due to spiraling debts and aggressive sanctions in the long run. With the tumultuous economic conditions in 2020, and the trade war against China during the Trump administration, the process gained speed. However, as the United States welcomes a new Biden era, the risks are likely to be negated.

Just as the 20th century saw the fall of Sterling Pound to the US Dollar, will the 21st century see the fall of the US Dollar to another currency? Only time can tell.